Power Your Insurance Processes and Systems with Real-Time Risk Intelligence

Situation

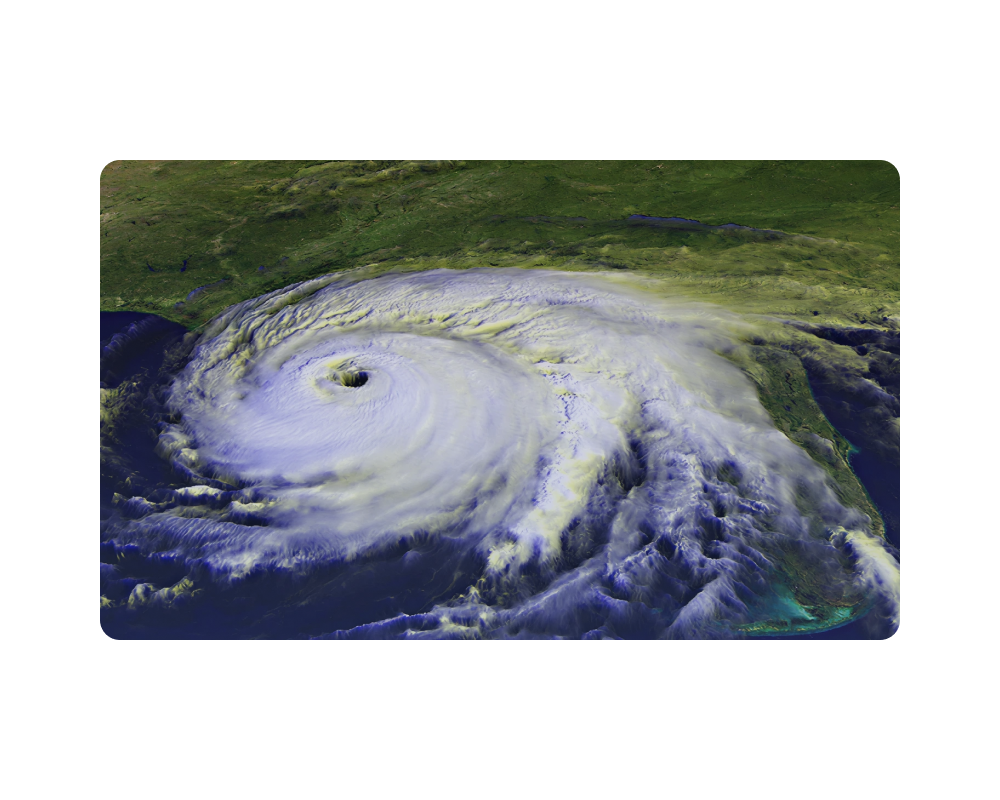

Insurable events unfold in an instant—from a fire at a policyholder site to a fast-moving natural catastrophe or a cyberattack on a key vendor. Without immediate, reliable intelligence, your teams miss critical First Notification of Loss (FNOL) windows, react too late to mitigate losses, and carry avoidable portfolio exposure.

Solution

Dataminr delivers real-time intelligence on critical events, threats, and risk to policyholders, prospects, and applicants—so you can mitigate losses, accelerate FNOL, and optimize claims operations.

Cyber & Data Breach Monitoring

Portfolio & Catastrophe Risk Modeling

FAQs

Dataminr detects the kinds of events insurers care about most—from fires, outages, and infrastructure failures at insured sites, to cyber breaches, natural catastrophes, and geopolitical risks. Because AI-powered alerts are delivered in real time—as the first signals of events are discovered across over 1M global public data sources—you can notify policyholders faster, guide them through loss-mitigation steps, and reduce claim severity. Earlier awareness also improves customer experience by enabling proactive outreach during high stakes events.

Dataminr does not replace the FNOL process—but it gives you the situational awareness to act sooner. Real-time AI-powered alerts can be used to trigger customer outreach, prompt FNOL submission, or prioritize response for large events. Claims teams can also use evolving event updates to anticipate surges, allocate adjusters, and direct resources where they’re needed most.

Dataminr’s AI-powered alerts and real-time intelligence can be fed directly into underwriting systems, catastrophe models, and portfolio monitoring tools to provide a more comprehensive view of customer risk, including exposures from their own operations and their third-party suppliers. Real-time intelligence can be used to refine pricing, stress-test portfolios against emerging threats, and identify likely business interruptions. You choose where and how to integrate the data—whether into off-the-shelf solutions or your internal models and dashboards.

Dataminr processes over 1M global public data sources in over 150+ languages, from over 170 countries, in real time. Our AI Multi-Modal Fusion AI cross-correlates across multiple sources, determines event severity, and connects related updates as situations evolve. Dataminr provides earlier visibility than traditional sources and a far broader scope, giving your teams critical lead time and information advantage to act.

Dataminr sends real-time alerts and event intelligence that includes key metadata such as event locations and company tickers; you use this comprehensive metadata to seamlessly match the alerts against your policies and assets. You maintain full control of policyholder data—Dataminr does not require access to identifying information on those in your book of business, ensuring sensitive customer information stays within your environment.