SUMMARY

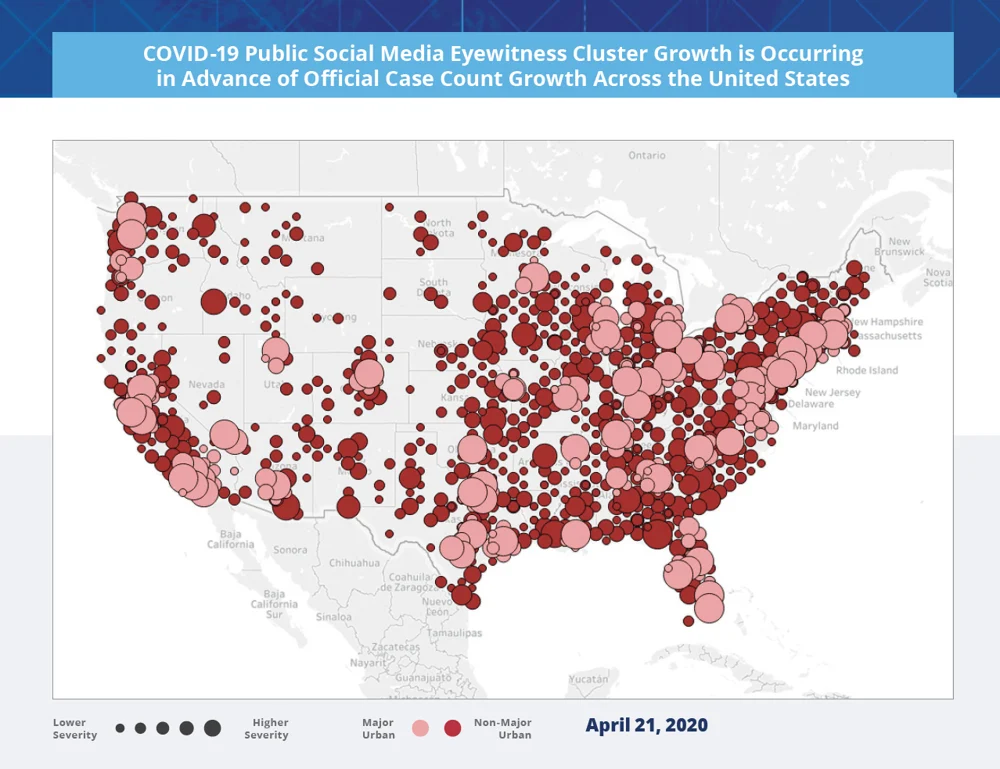

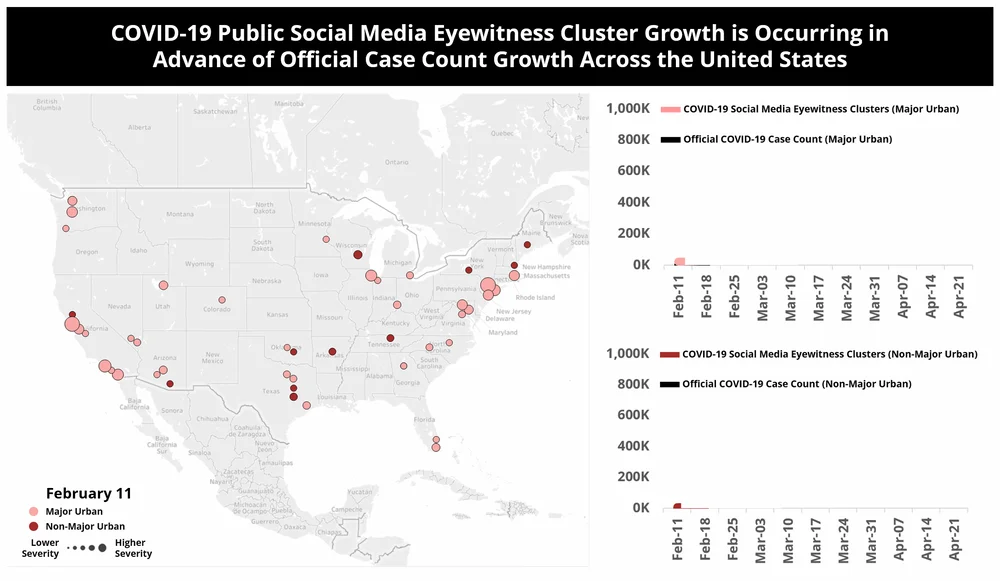

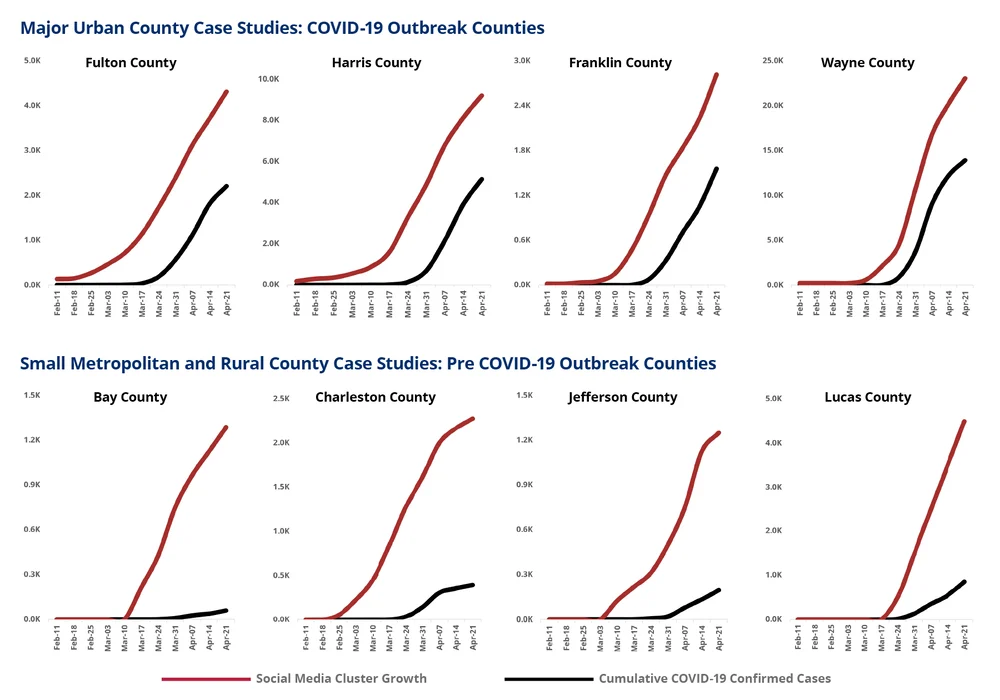

Dataminr has detected growth in clusters of eyewitness, on-the-ground, first-hand public social media posts in 22 small metropolitan and rural counties across eight states in the U.S., where exponential growth in COVID-19 official case count has yet to occur. Dataminr’s study also shows that cluster growth in major urban counties across the same eight states has been a leading indicator of virus outbreak hotspots 6-13 days prior to exponential growth in COVID-19 official case counts. The study suggests that county-level data patterns appear to be following the same pattern identified previously in U.S. states. In a March 30th study, Dataminr identified 14 U.S. states where the data suggested there could be an impending spike in case counts based on growth trends in eyewitness social media clusters. Within one week after publication of the study, the exponential case spike occurred in all 14 states.

IMPENDING OUTBREAKS

In the following eight U.S. states — Florida, Georgia, Indiana, Michigan, Ohio, South Carolina, Tennessee, Texas — Dataminr has identified 22 small metropolitan and rural counties, as of April 22nd, where exponential growth in public social media clusters has started, yet there has not yet been exponential growth in cases: Bay (FL), Charleston (SC), Chatham (GA), Clarke (GA), Escambia (FL), Greenville (SC), Hamilton (TN), Hidalgo (TX), Horry (SC), Jackson (MI), Jefferson (TX), Lubbock (TX), Lucas (OH), Manatee (FL), Monroe (IN), Montgomery (OH), Polk (FL), St. Joseph (IN), Summit (OH), Tippecanoe (IN), Vigo (IN), Volusia (FL).

DATAMINR’S PUBLIC SOCIAL MEDIA CLUSTERS

Dataminr’s public social media clusters are specifically comprised of emerging clusters of unique public social media posts that include people indicating they tested positive, people indicating they are experiencing symptoms, people indicating they have been exposed but not tested, first-hand accounts of confirmed cases from relatives, friends, and colleagues as well as COVID-19 related supply shortages and closures — scoped and specifically defined to create an authentic lens of “ground truth” amidst the COVID-19 outbreak.