A little over a year ago, business travel had not yet reached pre-pandemic levels, and wasn’t expected to until late 2024 or early 2025. Since then, we’ve seen a surge in corporate travel and a rebound that has exceeded expectations. And the future looks bright, “…with business travel spending projected to surpass $2.0 trillion by 2028.”

A portion of this growth can be attributed to:

- The advent in remote work which created a need for in-person team building and collaboration events and activities

- The need for more face-to-face client interactions

- The return to conferences and events with close to pre-COVID-19 attendance

Add to that the fact that the number of risks facing business travelers are on the rise, and it’s clear that organizations must ensure they have a travel risk management plan that accounts for today’s risks and trends.

Common Travel Risks

- Increased cyber threats, such as data theft via public WiFi

- Political and economic stability, such as geopolitical events and economic sanctions

- Health and safety risks, such as pandemics, health hazards

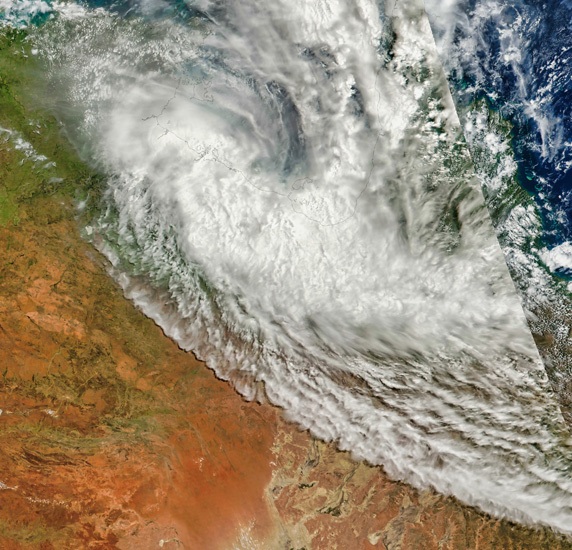

- Natural disasters and environmental risks, such as earthquakes and wildfires

- Misinformation campaigns, such as AI-generated deepfakes

Source: World Travel Protection

Here, we explore travel risk management with the aim of protecting organizations’ employees and reputation.

The travel risk management plan

Having this plan in place is critical to fulfilling businesses’ duty of care obligations and ensuring organizations can keep employees safe, no matter their destination or mode of transportation.

Organizations’ duty of care obligations have expanded since the increase in remote and hybrid work, with the return to business travel increasing the scope of today’s safety expectations.

However, there are still relatively few universal benchmarks for travel risk management best practices. One is the International Organization for Standardization’s (ISO) ISO 30130 standard for travel risk management. It provides guidance on duty of care obligations, some of which still differ from country to country.

To keep their business, reputation and workforce secure, companies have to understand the improvements they can and should make for stronger traveler safety, wherever employees are headed.

What ISO 30130 Travel Risk Management Covers

- Risk identification: Conduct research, consult travel advisories, consult with experts—and use it to inform decisions and develop mitigation strategies.

- Crisis management planning: This comprehensive plan outlines steps to be taken in case of emergencies.

- Travel assistance: Provided employees with access to a reliable travel assistance program and on-the-ground 24.7 support.

- Communication and check-ins: Regular communication channels with employees during their travels.

- Technology and tracking: Travel management tools and tech used to track travel itineraries and provide real-time assistance

Source: Global Guardian

Legal and ethical obligations for safe travel

Beyond ISO 30130 standards, there are very few precise requirements for duty of care and corporate travel protection. However, there are some proven practices that, if followed, can help ensure organizations meet their obligations for legal and ethical care:

- Conduct a travel risk assessment of relevant regions to better understand their potential threats

- Inform all employees of duty of care responsibilities and travel safety measures, including what they can do to reduce travel risk

- Have a clear process for contacting, informing and checking up on employees if they’re at risk. Ensure the right resources are available and ready to execute next steps

- Know the location of traveling employees so you can assess nearby risks

- Provide travel and health insurance for employees before departure

Reinforcing employee responsibility is particularly important. Employees should fully understand potential travel risks and the role they play in maintaining their safety. It’s critical that this be included in travel risk assessments and plans. If employees carry out tasks without the right protection, especially in an unfamiliar region or environment, organizations could be held liable.

Dataminr Protects Travelers From Active Shooter

In October 2024, an armed man barricaded himself inside the Four Seasons Hotel in Atlanta, Georgia, prompting a large police response and multiple road closures.

Dataminr alerted its customers to the threat in real time—hours ahead of official sources. As a result, customers were able to warn their traveling employees in or around the area.

Throughout the duration of the incident, they were able to help employees maintain awareness and stay safe via Dataminr’s ReGenAI—a new form of generative AI that provides live event briefs that automatically update as situations unfold, at the hyperlocal, regional and global level.

3 ways to improve duty of care and travel protections

Business travel is increasingly risky, putting a spotlight on security teams ability to protect employees and how they fulfill their duty of care. Some employees are at a high risk due to the nature of their travel:

- Visits to high-risk countries

- Working in high-risk industries, like oil and gas, healthcare and pharmaceuticals

- Working for a high-risk company

- Being in unfamiliar locations, especially where there are language barriers or geopolitical tensions

This means organizations have additional pressure to enhance their travel risk management strategies and plans. For large organizations this is an imperative as they often have hundreds or thousands of employees travelling at a time, making real-time risk detection increasingly difficult.

Below are some recommendations for how to do so effectively.

No. 1: Dig further into geographical risk

When developing a travel risk management strategy and response plan, be sure to take into consideration geopolitical and socioeconomic risks as well as those that may be endemic to specific countries, such as disease, storms, droughts and toxic chemicals.

Access to real-time information makes it easier to detect and respond to these potential threats—ensuring organizations know about them as soon as they happen. As a result, they can better protect their employees before, during and after travel, wherever employees are in the world.

No. 2: Conduct an employee health survey

Knowledge of employees’ pre-existing physical and mental health conditions—asthma, allergies, depression, heart conditions—allows organizations to better support those employees in times of crisis. Tread lightly and rely on HR partners as there are many rules and regulations around what health information companies can ask for and what employees are and are not required to disclose and to whom.

Additionally, review mandatory vaccinations employees may need when traveling to certain countries. Malaria, yellow fever, tuberculosis and typhoid fever are among the biggest threats internationally. Organizations should help employees meet vaccination requirements before departure to ensure they’re safe from potential illness.

No. 3: Be clear and transparent about compensation policies

It’s important to clearly communicate, as transparently as possible, who is responsible for what and under which circumstances. If someone has to be isolated in a hotel or be treated at a hospital, who pays? The same question holds true for vehicle and equipment rentals. If compensation policies are not widely and clearly communicated, organizations expose themselves to legal ramifications and some employees may have difficulty accessing resources.

Or take for example the uptick in bleisure travel, where employees extend their business trip for personal pleasure. It’s been shown that over 25 percent of bleisure trips increase levels of risk exposure and 12 percent have required organizational support while traveling overseas. This raises questions about where and when duty of care applies, which should be determined and clearly communicated beforehand—and made an integral part of travel risk management plans.

Nonetheless, organizations should ensure they have clear travel risk management strategies, policies and procedures in place now to better protect employees and secure company data and assets. Success hinges on organizations’ ability to continually assess and update strategies, policies and procedures to keep pace with the growing list of business travel risks—from cyber attacks and geopolitical uncertainty to an expected rise in health risks.

Protect Your Traveling Employees

See how Dataminr Pulse for Corporate Security helps organizations like yours ensure duty of care and the safety of employees traveling for business.

Learn More

This article has been updated from the original, published on September 5, 2023, to reflect new events, conditions or research.