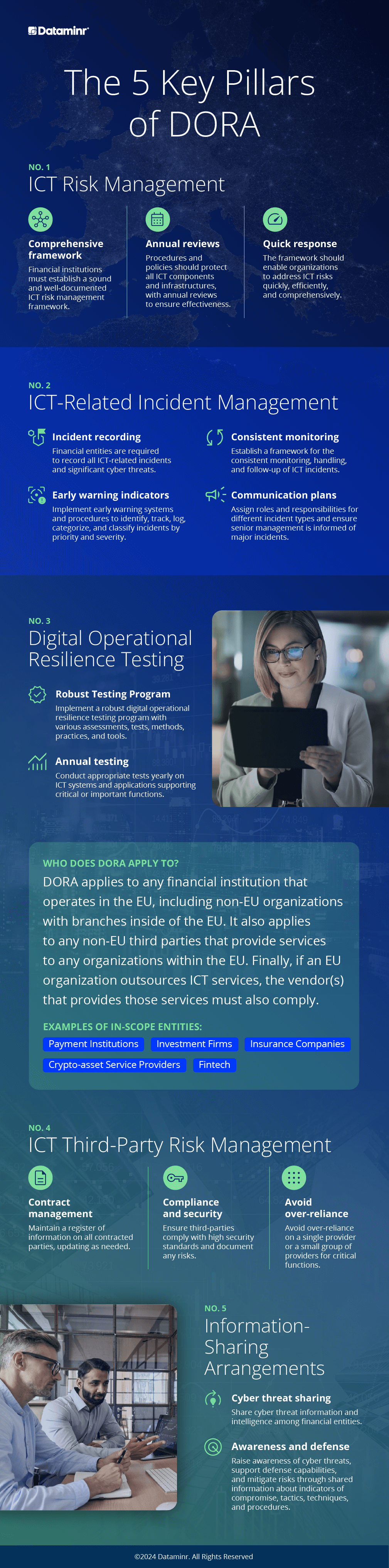

The Digital Operational Resilience Act (DORA) is a comprehensive regulatory framework enacted by the European Union (EU) to bolster the digital resilience of financial institutions against information and communications technology or technologies (ICT) risks. In light of increasing cyber threats and digitalization, DORA aims to ensure that financial entities can maintain operations during significant disruptions.

Here we explore the five key pillars of DORA, detailing the requirements and implications for financial institutions.

DORA represents a significant step toward creating a unified and robust framework for enhancing digital resilience within the financial industry. By adhering to its five key pillars, financial institutions can better manage ICT risks, respond to incidents and ensure operational continuity. To stay compliant and ahead of cyber threats, financial entities must integrate these pillars into their operational strategies and frameworks.

To learn more about DORA and its implications, read our comprehensive explainer: The Digital Operational Resilience Act: Understand the Key Impacts for Financial Institutions.